At some point, borrowers might be paying additional in principal than interest and that's if they can Construct fairness within their house much a lot quicker. You'll find other fees As well as the every month home loan payments on your $140K home finance loan, such as home tax, residence coverage, HOA service fees, PMI, utility bills, and home upkeep. Initially-time house prospective buyers ought to keep an eye on these fees as they add up immediately.

Acquiring a house loan for a house is really pretty uncomplicated. I like to recommend these actions. 1. Speak with your neighborhood lender. two. Consider a home loan service provider to check out premiums and have an internet estimate. A home loan banker commonly needs various a long time of tax returns as well as a assertion of one's belongings and debts.

Use this loan calculator to ascertain your monthly payment, interest rate, number of months or principal amount with a loan. Come across your excellent payment by shifting loan sum, interest price and time period and viewing the impact on payment amount.

Enter your specifics higher than to determine the month-to-month payment. What's the down payment over a 140k household?

It's attainable that only one quarter of 1 percent can end up preserving tens of thousands more than the size of the loan. Also, beware any expenses added to the house loan. This will vary significantly depending upon the house loan company.

It is really probable that just one quarter of one p.c can finish up preserving tens of hundreds over the duration on the loan. Also, beware any costs additional for the mortgage loan. This may vary tremendously with regards to the property finance loan supplier.

They will also want information of your private home acquire. Commonly, you will get an appraisal, a home inspection, and title insurance coverage. Your housing agent or bank can organize this for you personally.

One of the surprising points I discovered is how a small change in charges can have an affect on your complete total compensated. Try utilizing the calculator to examine various desire charges.

One of many astonishing matters I learned is how a little big difference in charges can affect your full amount paid out. Consider utilizing the calculator to check different desire costs.

Insert house taxes, insurance policy, and maintenance expenses to estimate General house ownership costs. Spend a greater down payment or refinance to reduce month-to-month payments. Will not be afraid to question your lender for greater prices. How can interest costs influence a house loan of 140k at a six APR?

They will also want aspects of your own home invest in. Generally, you will get an appraisal, a house inspection, and title coverage. Your real estate agent or bank can prepare this to suit your needs.

This is termed private property finance loan insurance policies, or PMI which can be a security that lenders use to safeguard on their own in the event of default in the borrower.

When you get out a loan, it's essential to pay out again the loan furthermore fascination by making standard payments to the financial institution. To help you think of a loan being an annuity you spend into a lending establishment.

five% desire charge, you'll be thinking about a $503 monthly payment. Make sure you Take into account that the exact Price and month to month payment on your house loan will fluctuate, based its size and terms.

Acquiring a home loan for a home is definitely really clear-cut. I like to recommend these ways. one. Speak with your local lender. 2. Consider a property finance loan supplier to watch rates and acquire an internet based quotation. A house loan banker typically desires many several years of tax returns in addition to a assertion of your respective belongings and debts.

You can also generate and print a loan amortization routine to discover how your month to month payment pays-from the loan principal additionally interest around the class of the loan.

Investigating this loan table, It is simple to find out website how refinancing or spending off your house loan early can definitely impact the payments of your respective 140k loan. Add in taxes, insurance policy, and upkeep charges to obtain a clearer photograph of Total property ownership costs.

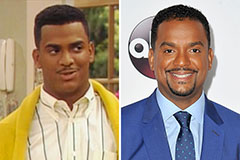

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now! Jeri Ryan Then & Now!

Jeri Ryan Then & Now!